Diversify your supply chain through strategic sourcing

By Melzie Robinson, HANCOCK Consulting Partner

This article is especially timely given the global impact of the COVID-19 pandemic. Diversifying the supply chain is vital to securing optimal supply options, lowering costs, and improving efficiency—ultimately supporting sustainable brand value. As of May 2020, the U.S. imposed tariffs on $550 billion of Chinese goods, while China responded with tariffs on $185 billion of U.S. products. Both countries have also threatened further measures affecting U.S. businesses in China. Negotiations are still underway. Meanwhile, governments have introduced large economic stimulus packages amid shutdowns that have created global planning and sourcing uncertainties. Manufacturers face major challenges related to supply chains, operations, workforce, and revenues.

With tariffs and trade tensions between the U.S. and China, reducing supply chain sourcing risk has become even more crucial in today’s economic climate. This article covers current supply chain developments, future trends, executive concerns over risks, and real-world outcomes we have achieved with clients by mitigating risk through supply chain diversification.

Starting with the end goal in mind

We observe that only two out of ten companies qualify as true “mitigators” of supply chain risk. We’ve supported many clients aiming to lower such risks through approaches including:

- Redesigning the supply chain and sourcing strategy

- Minimizing tariff effects by creating a more efficient supply chain

- Adjusting the global sourcing portfolio

- Reevaluating manufacturing, logistics, and contracting footprints

Consider where the biggest opportunities may exist within your own organization.

As demonstrated below, we have identified supply chain opportunities and reduced risks across various industries using our proprietary 11-gate process. In every case, clients bring unique challenges, and unlike many consultants, we listen carefully before taking action.

Examples of global supply chain cases

| Client | Approach | Risk reduction | Total savings |

|---|---|---|---|

| 1. Industrial manufacturer | Revamped supply chain, applied 11-gate process, and utilized volume across global regions covering 80% of spend. | Reduced risks from trade and high-tariff countries, chose top suppliers, reinvested savings to lower customer prices in competitive markets. | $210MM |

| 2. Specialty chemical company | Price cuts, volume discounts, rebates, long-term contracts, favorable payment terms | 5-year supply contracts with leading firms, reinvested savings to reduce pricing in competitive markets, co-location plant, enhanced S&OP forecasting. | $50MM |

| 3. Private equity firm | Created supply chain strategy, enhanced sourcing, and optimized manufacturing, logistics, and contracting footprint | Lowered supply chain costs, standardized processes, lean operations, improved warehouse and transportation efficiency. | $112MM |

| 4. Construction company | Realigned global sourcing portfolio | Reduced suppliers, added value-added services | $105MM |

| 5. Equipment manufacturer | Minimized tariff effects by building a more efficient supply chain and establishing an Asian procurement office. | Mitigated trade and tariff risks, selected best suppliers, reinvested savings to reduce customer pricing in competitive markets | $87MM |

What led us to the current crisis?

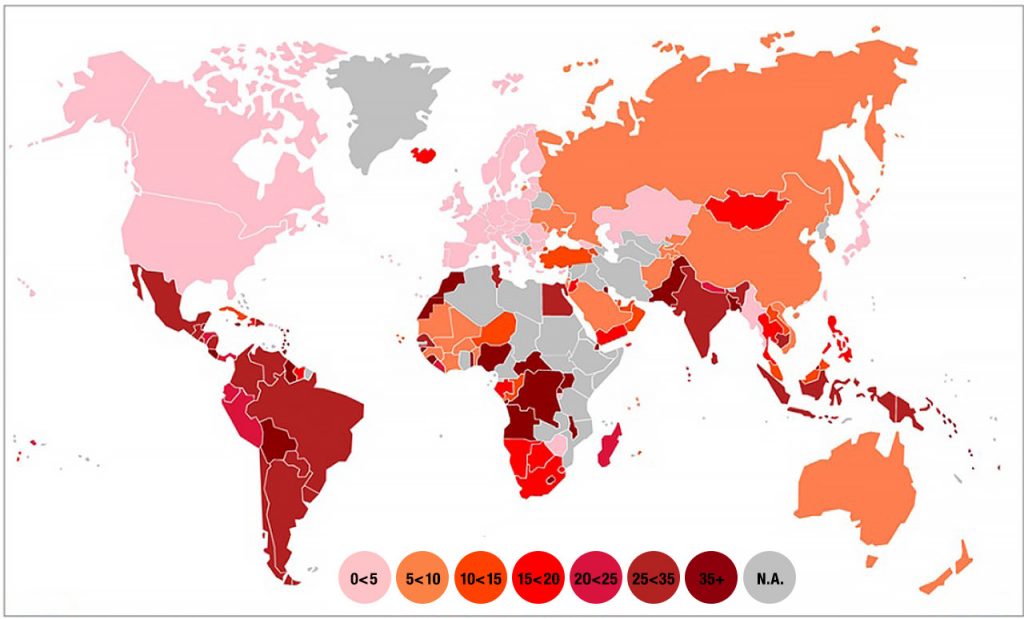

In developing our supply chain strategy, we analyze global trends and the current trade and tariff environment for each spending category, illustrated by the WTO’s global chart for electrical machinery (darker shades indicate higher tariffs in 2017).

Grasping the current situation is crucial as tensions from the U.S.-China trade war rise, supply chain disruptions pose risks, and declining demand dampens business confidence and expenditures. For instance, CNBC recently noted, “President Trump’s newest move in the trade war prompted what strategists call the strongest reaction so far from China — a weakening of its currency to a critical level markets had considered a red line.”

Uncertainty Lingers Around U.S.–China Tariff Disputes

**| Date | Amount | Tariff | Examples of Products Imported from China |

|---|---|---|---|

| 06/15/2018 | $33B | 24% | Automobiles, aircraft parts, mechanical tools |

| 09/01/2018 | $17B | 24% | Industrial chemicals, locomotive gear, scooters |

| 10/05/2018 | $195B | 11% | |

| 06/01/2019 | 24% | Raised from 11% to 24% on various products: stationery, cloth goods, engine parts, watercraft | |

| 10/10/2019 | $295B | 11% | Garments, ovens, monitors, polymers, gardening equipment |

| 02/01/2020 | Initial trade agreement: U.S. tariffs on $545B of Chinese goods, China on $180B U.S. imports | ||

| 06/10/2020 | China removed tariffs on select goods amid COVID-19 (e.g., antiseptic supplies) |

What Are Leading Corporations Doing? Sound Familiar?

Firms throughout the U.S. are conducting tariff impact assessments and arriving at similar tough conclusions about their supply chains:

- Lincoln Electric: The welding gear producer is applying extra fees on consumables to counterbalance tariff expenses.

- Alcoa: This aluminum manufacturer revised its earnings outlook down by $500 million, blaming levies on aluminum imported from Canada.

- General Electric: Facing $400 million in annual tariff-related costs, the industrial giant is evaluating supply chain changes to reduce the burden.

- United Technologies: Owner of Carrier, Otis, and Pratt & Whitney, the firm reports earnings pressure due to tariffs and is seeking savings through cost cuts.

Looking Ahead

No one can predict with certainty, but analysts warn the situation may deteriorate before improving. On July 27, 2019, Oxford Economics projected that an escalated U.S.–China trade conflict—with 10% U.S. tariffs on an added $400 billion in Chinese goods and 25% duties from China on all U.S. imports—could trim U.S. GDP by 0.7% in 2019, cut Chinese growth by 0.8 percentage points, and result in over 700,000 U.S. job losses—**and this was all before the pandemic!**

The manufacturing sector has faced major setbacks due to COVID-19, impacting supply chains, workforce availability, operations, and overall income. Similar disruptions are affecting industries like Travel, Retail, Energy, Technology, and Healthcare.

Data provided by Computer Economics; Avasant

Self-Reflection: Key Questions Leading Companies Should Consider

Uncertainty spans many spending areas. As a result, you, your leadership, and investors might wrestle with three critical supply chain risk questions:

- Are you sourcing and producing in the right countries amid changing tariffs, trade policies, and COVID-19 challenges?

- Do you have the best supply partners who meet your customers’ service and lead time expectations?

- Can your supply chain teams deliver projects effectively to impact the bottom line?

Many companies are caught off guard by failing to initiate comprehensive efforts to address these concerns. Strong organizations fully manage their risks. Excelling in just one area is not sufficient. High-risk companies suffer from strategic errors, poor partner selection, or weak project execution. As you read, consider if these situations sound familiar.

Below is our classification of companies that do not mitigate country, supplier, or execution risks versus those that do.

- The efficient non-strategists: As Stephen Covey notes, “If the ladder isn’t leaning against the right wall, every step only takes you to the wrong place faster.” These companies neglect focusing on the strategic sourcing or manufacturing locations. It’s like building a perfect ladder but placing it on the wrong wall. Sourcing or producing in unsuitable countries creates significant demand risks by compromising responsiveness, lead times, and cost structures, resulting in mediocre customer service. Companies must conduct thorough due diligence on trade and regulatory developments, country-by-country and region-by-region. Does this describe your company?

- Vendors instead of supply partners: Many confuse vendors with true supply partners. Vendors supply tools; partners help build through innovation, parts, and process improvements. Thorough supplier research expands the supplier base beyond incumbents, reducing risks. Competitors who choose better partners gain advantages in market share, cost, and service. Sound familiar?

- The academics: These companies have a clear strategic plan and good partners but struggle to realize financial gains due to weak implementation capabilities. Over 70% of potential benefits fail to impact the bottom line. Do you hear “Where are the results?” in meetings?

- The supply diversifiers & risk reducers: These companies understand how suppliers, their locations, and execution interrelate to manage risk. They build agile supply chains with diverse sourcing. If this fits your company, well done—you’re leading the pack.

Practical Business Tips

Consider best practices such as using varied supplier types, prioritizing categories, and building savings reserves.

1. Selecting Suppliers

Strategically, it’s vital to distinguish supplier types (strategic partners vs transactional) and identify what your company needs. This categorization guides risk mitigation across the supply chain.

For instance, knowing your supply base’s manufacturing footprint helps assess exposure. Key parts—critical to products and with high spend—should ideally be sourced from multiple countries to reduce tariff risks.

Strategic partners must agree on contingency plans for tariffs. Suppliers with multiple facilities might shift production to low or no-tariff countries. Details matter—knowing which parts and tools to move, plus quality and logistics impacts, eases production shifts.

Some good suppliers have a single facility. To keep flexibility, production can be split among suppliers in different countries. Understanding a supplier’s current and future capacity lets you adjust based on market limits.

Top companies execute well by working with “best of the best” partners with strategic footprints. They focus on sustainable results through ongoing training and coaching of supply chain teams.

Global supply chains usually include both strategic partners and transactional suppliers. At HANCOCK, we tailor supply bases to client needs, maximizing financial impact and minimizing risks.

2. Prioritizing Sourcing Categories

Risk mitigation involves organizing by sourcing categories—classifying all commodities, components, products, and services by supply risk and profit impact.

- Supply risk is high when materials are scarce, or affected by instability, trade conflicts, natural disasters, complex logistics, or limited suppliers.

- Profit impact is high when categories contribute significantly to output, either by volume (e.g., aluminum in appliances) or quality (e.g., glass for luxury windows).

3. Building a “Savings Reservoir”

Designing supply chains to reduce risk while cutting costs offers strategic advantages. Shifting to Best Cost Country Sourcing saves millions, creating a “reservoir of savings” from price, logistics, value engineering, and operations efficiencies. HANCOCK partners with clients to leverage this advantage.

For example, clients have lowered product prices, boosting market share. Amid new tariffs, many stayed price-neutral while competitors passed costs to customers. Others invested in technology, systems, and personnel. Wise use of savings delivers even greater returns.

Case Studies

Here are three category-level examples where HANCOCK helped companies mitigate risk. In each case we:

- Created a 5-year strategic supply chain roadmap

- Reduced supplier, trade, and currency risks

- Found pricing and operational savings

- Delivered training to build sustainable skills

| Scope | The company spent $130 million annually on hydraulics. Its supply base was fragmented, made up of numerous small firms across the U.S., China, and Germany. Production of hydraulic cylinders was centralized at one plant to consolidate spending. |

| Approach |

|

| Results |

|

| Scope | The company spent $200 million annually on raw materials. More than 90% of the spend was concentrated with a single supplier. The company faced constant price hikes or risked production halts. |

| Approach |

|

| Results |

|

| Scope | The company spent $150 million annually on electrical components, mostly sourced from China. Despite lower prices than domestic options, issues with quality, delivery, and packaging led to high operational and logistics costs, straining supplier relationships. |

| Approach |

|

| Results |

|

Evaluate your company’s performance in global best cost country sourcing

Here are three questions for your organization to consider:

- Are you merely experimenting (level 1) or fully leveraging global advantages (level 5)?

- How do you think your competitors rank?

- What level do you aim to achieve?

Diversifying Supply Chains:

Supporting Companies to Enhance Their Best Cost Country Sourcing

Exploring the Potential

- Identify the opportunities of Best Cost Country Sourcing (B.C.C.S)

- Source certain products or components on a limited scale

Stage 1

Buying Components and/or Finished Products

- Prioritize lowering purchasing expenses

- Gain important insights into the supplier network

Stage 2

Create a Comprehensive Sourcing Strategy

- The sourcing plan covers:

- Components

- Selected products

- Talent and R&D

- Competitive edge comes from:

- Strong supplier partnerships

- Product innovation

- Exclusive tools and processes

- Market insights

Stage 3

Implementing an Integrated B.C.C.S Strategy

- Consider Best Cost Country Sourcing (B.C.C.S) as both a market opportunity and sourcing destination

- Utilize synergies between export sourcing and in-country manufacturing

- Coordinated capacity planning

- Adaptable production processes

Stage 4

Maximizing Global Advantage

- Harness global synergies in:

- Manufacturing cost structures and strategies

- Supply chain management

- Utilize the best capabilities worldwide

- Optimize use of high-cost assets

Stage 5

With COVID-19 disrupting supply chains globally, leaders are tackling challenges across multiple areas as a clear call for both immediate and long-term changes. In particular, companies are concentrating efforts on Purchasing, Best-Cost Country Sourcing, Manufacturing, Value Delivery Models, and Distribution & Logistics Networks. What is your current top priority?

Begin addressing your company’s blind spots

S.O.O.S.—Supply Chain Success and Results Stem from a Comprehensive Diagnostic

Insights are gathered through commodity and individual surveys, site visits, supplier interviews, and data analysis. The findings are then organized according to the S.O.O.S. framework:

Strategic

- Major strategic challenges confronting the company

- Recognition and management of critical issues and obstacles

- Purchasing tactics and supply chain operations

Operational

- Daily management of suppliers and operations

- Departmental initiatives and tasks

- Ongoing enhancement of sourcing procedures

Organizational

- Purchasing department’s organizational setup

- Skills and capabilities of engineering and purchasing teams

- The role of purchasing within the company

- Coordination with other departments

Systems

- Network architecture and software systems

- Application of e-sourcing tools and data analysis

- Technology utilization across the purchasing organization

We begin with a concise supply chain and sourcing evaluation, applying our S.O.O.S. model to identify what’s effective in your organization and uncover any supply chain blind spots.

The final assessment reveals where your supply chain risks lie, highlights savings opportunities, and outlines how to implement strategies that maximize financial benefits while reducing risk.

HANCOCK Partners have achieved over $20 Billion in savings across 20,000 categories, delivering 15-23% savings and driving 50% to 200% typical client EBITDA growth through strategic sourcing initiatives. We’ve reviewed more than 500,000 supplier profiles (large-scale RFPs), led over 5,000 supplier negotiations, and conducted thousands of executive training sessions. Our team has the expertise and tools to produce results.

If these challenges resonate with you, let’s connect. Please complete our inquiry form or call us anytime at +1 617 613 8081. We’re ready to assist.